On 20 May 2021 the UK government published Great British Railways – The Williams-Shapps Plan for Rail.

The positive take-away is, many of the ideas in this white paper are broadly good and show a real awareness of the problems the sector faces.

Some Background

The Williams Rail Review was originally launched in September 2018 following the disastrous timetable change. However, the arrival of the coronavirus pandemic and the associated restrictions on movement led to an almost complete collapse in passenger numbers. Under the existing franchising agreements with train operating companies, the revenue risk lay with the franchisees. In order to keep services running for essential workers – highlighting rail’s system-critical role – the British government first implemented Emergency Measures Agreements and then Emergency Recovery Measures Agreements by which train operating companies were (and still are) paid a management fee for running services, but with revenue risk handed over to government (except for some revenue sharing arrangements where appropriate). The situation demonstrated the failings of the franchising system, which was already struggling, evidenced, for example, by the collapse of the East Coast franchise.

This plan, then, aims to address that and other issues faced by Britain’s railways. Importantly, it expects that much of old passenger demand will return: “Millions of us, imprisoned in front of flickering screens, yearn for human contact. Employers and businesses know that creativity, collaboration, and deal-making are best done in person.”

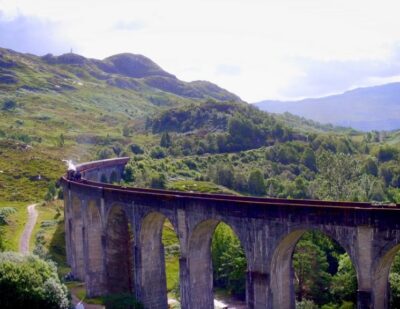

The white paper also acknowledges that without the railways “our cities would not function, critical freight connections would be cut off, carbon emissions and pollution would rise, and mobility would fall – not just for the millions of people without cars, but for drivers too, as the roads became clogged”. Its conclusion: there needs to be somebody in charge – one network under single national leadership.

Importantly, the white paper voices a commitment to growing passenger numbers and increasing the size of the railway network. It expresses support for rail freight and open access operators.

It is keen to emphasise the role of the private sector. “Simplification is more important than nationalisation” is one of its headlines – and this is a fair point. The rail market has many, many different players in it, even before including the supply chain. This aspect makes decision-making slow and changes more expensive.

For the first time, there will be a 30-year strategic plan in order to tackle the lack of direction. Bringing track and train – though not rolling stock ownership – under one roof will help cut down on the fragmentation and lack of direction the sector faces.

There is a nod to active travel as well with a stated commitment to making it easier for passengers to leave their bicycles at stations and for there to be more spaces for bicycles on trains so passengers can complete their end-to-end journeys.

The Key Proposals

- A new public body, called Great British Railways, will own the infrastructure, receive fare revenues, run and plan the network, and set most fares and timetables. Network Rail will be absorbed into this body, as will many functions from the Rail Delivery Group (RDG) and the Department for Transport (DfT).

- A new brand identity with national and regional sub-identities.

- A simplification of tickets with standardised digital ticketing as well as affordable Pay As You Go fares – in the style currently successfully used in London – and new flexible season tickets.

- Trains will be co-ordinated better with other modes of transport such as buses.

- An end to franchising and a move to concessions. The expectation is for there to be much more competition for these concessions than there was for franchises. These new contracts will be called Passenger Service Contracts.

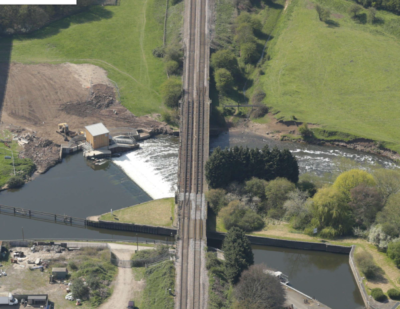

- A statutory duty by Great British Railways to support rail freight with improved track access rights.

- A significant change to the role of the ORR to help improve accountability, transparency and efficiency.

What Will Great British Railways Do?

Under the government’s plans, Great British Railways will develop both a 30-year strategic plan – the Whole Industry Strategic Plan to be published in 2022 – set by ministers and 5-year business plans. It will manage the railway budget and be in charge of delivering the government’s priorities for rail. A positive aim of Great British Railways is the end to stop-start funding long lamented by the supply chain, due in part due to the absence of a long-term vision. This plan will also include costed options to decarbonise the whole rail network to meet the net-zero commitment, noting that “electrification is likely the main way of decarbonising the majority of the network”.

Among the key problems identified in the white paper were a lack of clear accountability and fragmentation in the sector. This new body aims to address both of these with whole-system planning and operations. Finances will be brought together across track, train and the rail estate. Ultimately, this will unite costs and revenue.

Interestingly, the white paper contains this snippet: “Great British Railways will need to include meaningful numbers of people in middle and senior management roles with substantial experience outside Network Rail, including in some cases from outside the rail and transport industry altogether; and more people with retail and customer relationship experience.” The aim here is to prevent a continuation of the culture that currently exists at Network Rail and bring about actual change.

Great British Railways will have five regional divisions that will be “responsive and accountable for their whole system in their areas, including budgets”. The regional boundaries of these divisions will be able to evolve over time, should the need arise.

What Will a Passenger Service Contract Look Like?

Under the concession-based Passenger Service Contracts, Great British Railways will specify service levels and set fares as well as take the revenue risk. The train operating companies will receive a fee for operating services. Great British Railways will also specify branding.

Under the old franchising system, TOCs designed their own timetables and set many fares. They also held the revenue risk. This meant that competition for franchises was based on “complex and uncertain revenue forecasts”, which resulted in low numbers of bids. In fact, the paper notes, since 2012 around 2/3 of contracts have been awarded without competition.

There will be a stepping stone to the Passenger Service Contracts. These will be National Rail Contracts taking over from the emergency agreements put in place during the pandemic.

A key aspect of the Passenger Service Contracts will be that operators will get paid performance incentives on top of the fixed fee for running services. These incentives will be based on quality of service, punctuality, the passenger experience, revenue protection and train capacity. There will be revenue incentives to encourage TOCs to drive growth in passenger numbers. There will be scorecard linked incentives for collaboration and innovation. Interestingly, targets will not be fixed over the contract terms. Instead, they will be flexible. This will address an issue with the current franchises where almost all of the investment came early, not taking new technologies into account.

Something Missing?

The white paper addresses the desire to achieve good value for money for taxpayers and passengers at length. It talks about lowering and reducing costs, managing costs and achieving cost efficiencies. One area it does not touch on is rolling stock companies (ROSCOs) – the private companies that own Britain’s rolling stock and lease it to the train operating companies. They are an additional layer in the system that could have been brought in-house, into Great British Railways, to bring the rolling stock more in line with the aims of this white paper without the additional cost and bureaucracy of this middleman. The three established as part of rail privatisation in Britain were Porterbrook, Eversholt Rail and Angel Trains.

A further aspect that the white paper does not mention is modal shift. It talks about growing passenger numbers and the network. However, growing both of these could leave the percentage of passengers travelling by rail roughly the same, with the same percentage increase in both network size and passenger numbers. A truly revolutionary move would be a target of doubling rail’s modal share from its current ~10% to 20% for both passengers and freight.

Conclusion

The ideas and plans laid out in this white paper are broadly good and will do much that is positive for the rail sector. Moving to a concession-based model is good. More accountability is good. More long-term planning is good. Growing passenger numbers and the rail network is good. But a word of caution. These ideas need to be implemented well. A centralised body that supports the wrong developments will not improve the railways. A centralised body that does not, for instance, support a rolling programme of electrification in line with Network Rail’s recommendation that 86% of the as-yet unelectrified track would be best served by being electrified would still leave the railway in a poor state. A focus on re-opening lines that the government closed over the 20th century, and primarily in the 1960s rather than building lines where they are most needed today (which may or may not be different) would be misguided. This white paper presents the new structure of the railways in Britain. May that structure be a force for positive change.