Canadian Pacific and Kansas City Souther, two of the seven North American Class 1 railroads, announced Sunday that they have entered into a merger agreement under which CP would acquire KCS in a stock and cash transaction of around 29 billion USD.

The figure includes the 3.8 billion USD that KCS has in outstanding debts. Both boards unanimously supported the move.

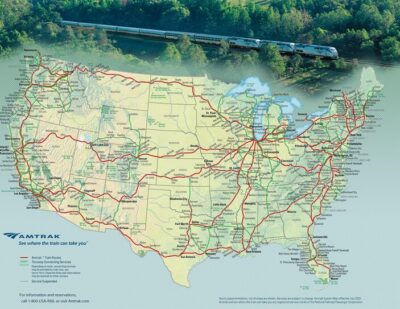

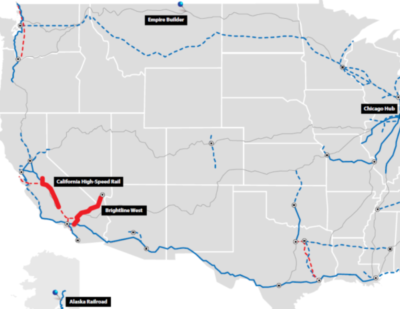

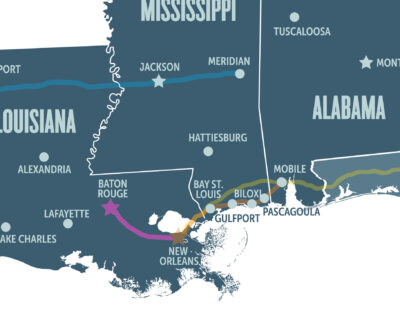

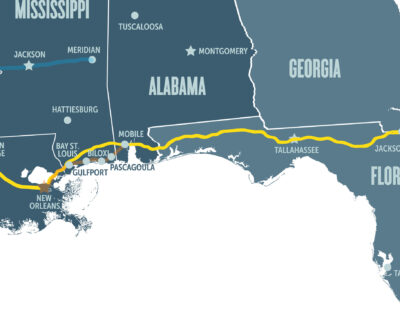

Should the Surface Transportation Board (STB) approve the deal, the new railroad would be the first whose network would connect Canada, the United States and Mexico. Canadian Pacific’s network largely runs east-west across southern Canada and the northern US with a route running down to Kansas City, while Kansas City Southern’s network runs southwards from Kansas City into Mississippi, Louisiana, Texas and Mexico, meaning that these two railroads have no route overlap. A merger between the two companies would therefore not reduce competition on existing connections.

Canadian Pacific and Kansas City Southern are the two smallest of the seven Class 1 railroads and would remain the smallest even after the merger, should it be approved. Together, the new company would operate in the region of 20,000 miles of track, employ almost 20,000 people and generate an annual revenue of around 8.7 billion USD, based on 2020 figures.

“This will create the first U.S.-Mexico-Canada railroad, bringing together two railroads that have been keenly focused on providing quality service to their customers to unlock the full potential of their networks. CP and KCS have been the two best performing Class 1 railroads for the past three years on a revenue growth basis.”

Mr Creel also noted that this merger would come at a good time, given the new USMCA trade agreement between the three countries.

“The new competition we will inject into the North American transportation market cannot happen soon enough, as the new USMCA Trade Agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before. Over the coming months, we look forward to speaking with customers of all sizes, and communities across the combined network, to outline the compelling case for this combination and reinforce our steadfast commitment to service and safety as we bring these two iconic companies together.”

Both Mr Creel and KCS President and CEO Patrick J. Ottensmeyer said hoped this transaction would help them improve fuel efficiency and lower emissions.

Next Steps

CP will next establish what it calls a ‘plain vanilla’ independent voting trust to acquire the KCS shares. Once shareholders agree the deal and the boards are happy with the closing conditions, CP will acquire the KCS shares and place them into the voting trust. The aim is to complete this step in the second half of 2021.

With the KCS shares in the voting trust, KCS will be insulated from control by CP until the Surface Transportation Board authorises control. KCS will continue to oversee the company while it is in trust.

The second step will be to obtain control approval from the STB as well as other applicable regulatory authorities. The STB review is expected for mid-2022. Once this approval is there, the two companies will be integrated. The combined entity will be called Canadian Pacific Kansas City (CPKC).

Calgary, the current headquarters of CP, will become CPKC’s global headquarters, while Kansas City will become the company’s US headquarters. Mexico City will remain as the Mexican headquarters, while CP’s current US headquarters in Minneapolis will remain as an important operational base, CP said.

Canadian Pacific’s Previous Merger Attempts

Canadian Pacific had tried to merge with another Class 1 railroad, Norfolk Southern. However, it abandoned those efforts in 2016 due to the severity of opposition from other railroads, shippers and politicians. The worry was centred around reduced competition. Prior to that, in 2014, CP had made a bid to take over CSX, which was also abandoned. At the time CP said it would not pursue efforts to merge with another Class 1.

Both Norf0lk Southern and CSX argued at the tine that the industry regulator, the Surface Transportation Board, would not approve either of these mergers because of competition concerns, therefore it was futile to invest time in that avenue.

The last time the STB approved a merger of significant size was in 1999. Norfolk Southern and CSX jointly took over Conrail and divided up its assets between them.