European Commission Says No to Alstom-Siemens Mobility Merger

Following an in-depth evaluation the European Commission denied the Alstom-Siemens merger under the EU Merger Regulation. It said this merger “would have harmed competition in markets for railway signalling systems and very high-speed trains”. It further said that the two parties in questions did not offer enough remedies to allay the Commission’s concerns. Siemens and Alstom first formalised their merger intention in September 2017.

Commissioner Margrethe Vestager, in charge of competition policy, said:

“Millions of passengers across Europe rely every day on modern and safe trains. Siemens and Alstom are both champions in the rail industry. Without sufficient remedies, this merger would have resulted in higher prices for the signalling systems that keep passengers safe and for the next generations of very high-speed trains. The Commission prohibited the merger because the companies were not willing to address our serious competition concerns.”

The merger plans would have “created an undisputed market leader in some signalling markets and a dominant player in very high-speed trains,” the Commission statement reads. Such a dominant position could force smaller competitors to go out of business and increase prices and reduce choice for customers.

It revealed that several National Competition Authorities in the EEA complained about the merger plans. Industry associations, trade unions, customers and competitors also voiced their concerns.

For example, Bombardier received the news of the merger denial with the following reaction:

“We are pleased that the European Commission, backed by the national competition authorities, has prohibited the proposed merger of Siemens and Alstom. This decision is based on the law and facts at hand after a very thorough 16-month investigation by the Commission.”

European Commission Concern 1: Signalling

The Commission’s investigation found that this merger would remove a very strong competitor from several mainline and urban signalling markets. This would negatively impact effective competition in an area essential to keeping rail travel safe. In particular, the Commission said, the merged company would have become dominant in ETCS train protection systems in the EEA and in stand-alone interlocking systems in several EU Member States.

Furthermore, the Commission was concerned in the area of metro signalling. It said the merged company would have become the market leader in CBTC metro signalling systems.

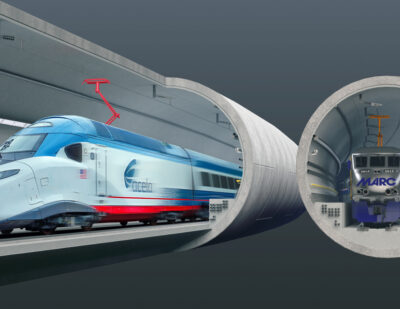

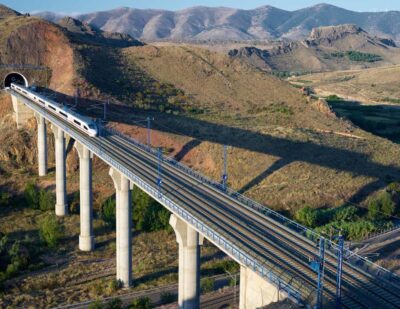

European Commission Concern 2: High-Speed Trains

In the area of very high-speed rolling stock, the merger would have reduced the number of suppliers in the field. It would have removed one of the main players of this type of rolling stock in the European Economic Area. As a result, the merged entity would hold a very large market share. This would have applied both in the EEA and in the rest of the world, excluding South Korea, Japan and China (which are not open to competition).

Essentially, “in all of the above markets, the competitive pressure from remaining competitors would not have been sufficient to ensure effective competition”.

One of the main reasons Alstom and Siemens wanted this merger was to be able to compete with China. In this regard, the EC looked at this potential future competition and found the following:

- signalling: Chinese suppliers are not currently present in the EEA. Furthermore, they have not tried to participate in any tender. As a result, it will be a very long time before Chinese suppliers can become a credible option for European infrastructure managers.

- high-speed trains: the EC believes it is highly unlikely that a new entry from China would be a competitive constraint on the two parties in the foreseeable future.

Siemens and Alstom put forward remedial measures. However, the Commission found them inadequate.

Siemens and Alstom Reaction

Siemens and Alstom say they regret the European Commission’s decision. They further regret that the remedial measures proposed were insufficient.

Alstom said:

“The remedies were extensive in scope and addressed all the concerns raised by the Commission in respect of Signaling or Very High Speed trains. In addition, a number of credible and well-established European players expressed strong interest for the remedy package, thereby fully confirming its viability.”

Alstom believes this decision is a “set-back for industry in Europe”. However, it will now continue to pursue its growth path independently, remaining a global leader in the mobility sector.

Siemens says it will now take the time to assess all the options for the future. It will then choose the best option for its customers, employees and shareholders. In the meantime, Siemens Mobility will continue to develop and expand its vertically integrated portfolio, from rolling stock to the automation and electrification of rolling stock and turnkey systems, intelligent transport solutions and associated services.