The Office of Rail and Road (ORR) has published its Signalling Market Study, following its update paper that was published in May.

The purpose of the market study is to increase competition in the railway signalling sector. It contains a number of measures that would help Network Rail – the infrastructure manager – to increase competition between signalling suppliers based on cost, quality and innovation to drive both efficiency and performance on the rail network.

The signalling market in Great Britain is currently worth 800–900 million GBP annually. This sector is undergoing a major modernisation programme to switch to digital technology. Consequently, this market sector is expected to increase greatly.

This level of work has to be affordable for Network Rail. It therefore must change how it procures and delivers signalling projects, the ORR says.

In its market study, the ORR has determined that the market as it currently stands is insufficiently competitive: there are not enough suppliers, costs are high and Network Rail does not have the right procurement practices in place to make use of its buying power. To improve the situation, the ORR has made recommendations aimed at attracting more suppliers into the sector in order to achieve better value for money. They include:

- A change to the procurement process to reward pro-competitive behaviour

- Increasing the number of suppliers and reducing Network Rail’s dependency on incumbent suppliers – Siemens Mobility and Alstom

- Ensuring that Network Rail’s procurement processes are truly competitive and do not unduly favour existing suppliers or penalise ‘first movers’ in new technology

- Providing suppliers with more certainty regarding the volume of work awarded to them and reducing the risk when developing new technologies

John Larkinson, Chief Executive, ORR said:There are more than 40,000 signals on the mainline network, with 65% of these needing to be renewed within the next 15 years – and essentially there are only two main players in the GB market for major signalling projects, namely Siemens and Alstom, who account for over 90% of Network Rail’s major signalling spend.

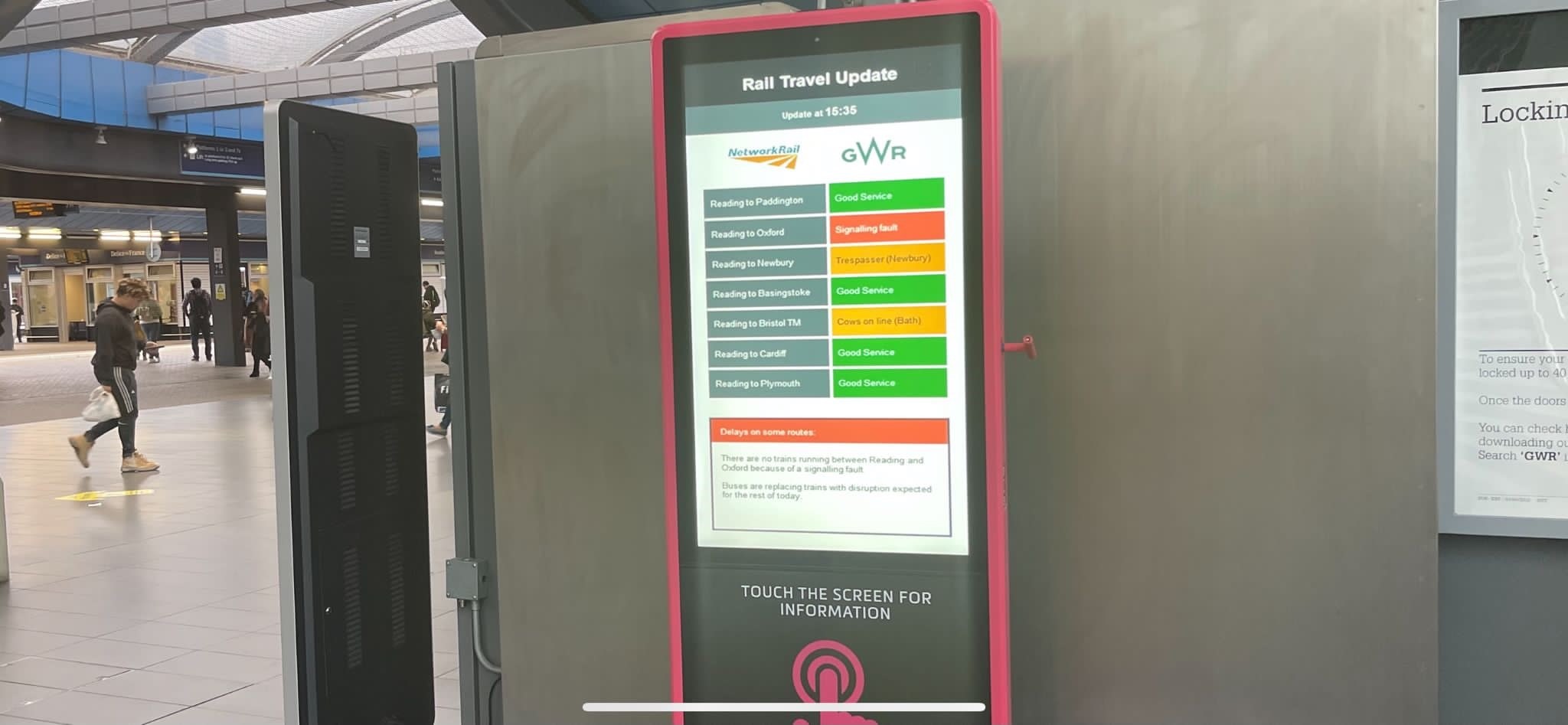

The shift from conventional to digital signalling systems has the potential to revolutionise the way the railway operates, delivering transformative improvements to increase capacity, lower unit costs, and reduce disruption.

Our recommendations set out how Network Rail can reduce reliance on the dominant suppliers, and make the market more attractive to potential new suppliers by increasing suppliers’ confidence in the market and reducing costs.

The ORR has given Network Rail a deadline no later than three months from the publication of the signalling market study to produce a strategy and plan that lays out how it will implement the findings and recommendations.