A conversation with Gabriel J. Lopez-Bernal, President of Icomera North America.

With the Bipartisan Infrastructure Law unlocking unprecedented funding opportunities, transit operators across the United States are gearing up to address critical upgrades for aging rolling stock and infrastructure.

Events like the APTA Rail Conference play a crucial role in facilitating discussions on challenges and sharing best practices that are essential to this transformative phase.

Central to these discussions is the industry’s approach to procuring new products and technologies. Many agencies, having deferred asset renewal for decades, face significant gaps in current knowledge and experience.

In light of these challenges, we sat down with Gabriel J. Lopez-Bernal, President of Icomera North America, to explore strategies for maximizing the impact of modern-day investments.

Tiana May (TM), Railway-News: In your experience working with agencies, are there any specific challenges that rail operators in the US currently face?

Gabriel J. Lopez-Bernal (GJL), Icomera: Notably, there’s an issue with standardization. The standards we use in the United States, particularly those established by APTA, are outdated and inadequate. This is something that APTA has acknowledged in our committee meetings.

Many standards have not been updated since the early 2000s. For instance, the video surveillance specifications adopted by APTA are over a decade old and remain unchanged. Here we are in 2024, yet we’re still relying on specifications that are far behind current technological advancements. It is remarkable and concerning that agencies are still being provided with such outdated guidelines.

TM: So without relevant standards to consult, do you find that agencies are restricted from rolling out new technologies?

GJL: We often find that agencies are still using outdated standards. For example, we encountered a transit agency that issued a tender based on obsolete specifications. When we asked them why they were pursuing such outdated technology, they admitted they lacked the expertise and simply used the available specifications.

These agencies are seeking help. They have the capital and the intention to invest in infrastructure, but they end up issuing RFPs based on outdated specifications. Due to the lack of available resources and updated guidance, these agencies often hire and rely on consultants to achieve their objectives. This approach is inefficient, costly, and can introduce bias into the procurement process. APTA should be stepping in to provide updated guidance, as otherwise, a lack of current standards can reflect poorly on the industry as a whole.

TM: In addition to requiring updated standards from industry bodies, do operators also need to adjust their procurement strategies for the modern era?

GJL: Absolutely. A recent example highlights the pitfalls of outdated procurement practices. An organization issued an RFP that specifically named a few vendors, which understandably excited those vendors. However, this approach is fundamentally flawed. By naming vendors directly, the organization essentially handed over control to these vendors, undermining competitive pricing and innovation.

Fortunately, it seems reason is prevailing. I’ve heard that the agency has realized the mistake and plans to revise the RFP, removing the specific vendor names and shifting to a performance-based specification. This is the direction the industry needs to take. It’s disappointing that in 2023-2024, we still see agencies specifying individual components and exact requirements, not realizing that this approach often drives up costs.

Procurements are inherently complex, and while it’s understandable that agencies want to be prescriptive, this can be dangerous. A performance-based process invites the market to propose solutions, allowing agencies to evaluate how vendors can meet their objectives cost-effectively and efficiently. This approach not only fosters innovation but also reduces lead times and ensures a more competitive, fair procurement process.

TM: Are there any potential barriers that will inhibit the US market from responding efficiently to performance-based tenders?

GJL: Yes, there are several significant barriers. One major issue is the chronic underinvestment in our infrastructure. This has led to a shortage of domestic rail car manufacturers, as the market has been neglected for so long.

For example, Metra has acknowledged that they are still using rail cars from the 1950s, extending their usable life out of necessity. While this has been a pragmatic short-term solution, it has had long-term negative impacts on the industry. By not investing in new rolling stock, agencies have inadvertently weakened the domestic manufacturing base. As a result, when they do need to procure new equipment, there are fewer suppliers available to meet their needs efficiently. This lack of consistent demand has created a gap in the market that hinders the ability to respond effectively to modern, performance-based tenders.

TM: Does this gap make the US an attractive market for rolling stock manufacturers globally, or is the competition likely to remain limited?

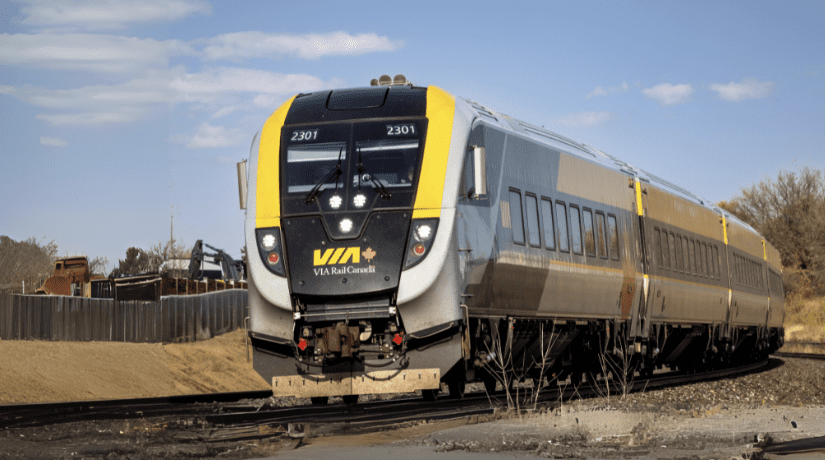

GJL: The situation in the United States is complex. On one hand, the US market has unique requirements due to FRA mandates and stringent crashworthiness standards. These standards exist because we mix freight with passenger rail, necessitating trains that can withstand collisions with freight trains. As a result, the US has created a highly specialized market where you can’t simply purchase commercial off-the-shelf models from companies like Stadler, CAF, or Hitachi.

In contrast, Canada, where we do a lot of business, doesn’t have these restrictions. They don’t have to comply with the same stringent standards and Buy America provisions. This allows them to open up the pool of bidders significantly, leading to more cost-effective and optimal solutions.

TM: So in this environment, what can agencies do to prioritise cost-effectiveness?

GJL: To achieve cost-effectiveness, agencies need to focus on the total cost of ownership (TCO) rather than short-term savings. I recently spoke with an organization that chose a competing product to our core router based solely on price. They soon realized that they had to purchase more units due to shorter lifecycles and higher failure rates. In contrast, our products are designed for longevity, with a lifespan of at least seven years, while some clients have been using them successfully for over 12 years.

Agencies must rethink their procurement strategies by considering the long-term implications of their purchases. Evaluating TCO and mean time between failures (MTBF) is crucial. Short-term fixes often lead to higher costs over time, as they require more frequent replacements and maintenance. This principle applies across rolling stock, technology, and infrastructure investments. Unfortunately, many agencies still focus on immediate costs rather than the broader, long-term view.

At Icomera, we prioritize partnerships with clients who understand the importance of TCO. We choose not to bid on projects that are solely price-focused because it indicates a lack of understanding about the true costs and benefits of the solutions. By shifting the focus to TCO, agencies can make more informed decisions that save money and resources in the long run. We are committed to advising and supporting our clients in making these strategic, cost-effective investments.

TM: With this need for smart procurement, should customization be encouraged or discouraged?

GJL: In a session I attended this week, OEMs were adamant about limiting customization. They presented basic examples, like changing the color of a train from white to blue, but generally, they prefer a one-size-fits-all approach. I believe this is a risky stance. OEMs are pushing for minimal customization to streamline their own processes and cut costs, but this can lead to suboptimal solutions for agencies.

OEMs are venturing into areas outside their core expertise, particularly technology, outfitting trains with what they believe is best. However, these decisions are often driven by cost-saving motives rather than what truly benefits the agency. Agencies need to be wary of this trend.

A significant concern is the OEMs’ push to lock agencies into long-term maintenance service agreements, positioning themselves as one-stop providers. This essentially creates a scenario where agencies are handcuffed to a single OEM for the next 15 to 30 years. Such arrangements can stifle innovation and flexibility, ultimately harming the public sector’s interests.

At Icomera, we advocate for smart, strategic procurement that prioritizes long-term value and flexibility. Customization, when done thoughtfully, can lead to more effective and efficient solutions that serve the public interest far better than a one-size-fits-all approach. We are committed to helping agencies navigate these complexities, ensuring that they understand the full TCO and make decisions that offer the best return on investment.

TM: Would you like to see agencies invest more in their own teams to take on more tasks in-house?

GJL: Absolutely. Transit agencies have become overly reliant on consultants. This dependency has resulted in a transfer of decision-making authority to consultants, which undermines the capabilities of the agencies themselves. My concern is that a similar trend will occur if we allow OEMs to own, operate, and maintain public sector vehicles. This could further erode the expertise within the public sector, leaving it unable to perform these tasks independently.

The issue extends to infrastructure development as well. On a per-mile basis, building infrastructure in the US is far more expensive than in Europe and other industrialized regions. This inefficiency stems from the public sector conceding too much control to consultants, whose primary interest is profit rather than public service.

We need to reclaim the expertise and responsibility that once characterized our public sector. A few decades ago, we had robust engineering talent within public agencies capable of handling design and development internally. However, this talent has been increasingly privatized, leading to higher costs for infrastructure development and deployment.

While it’s encouraging that we now have unprecedented funding for infrastructure investments, it’s crucial that we use these resources cost-effectively. Investing in our public sector workforce and reducing dependency on external consultants and OEMs can help ensure that we achieve the best possible outcomes for our infrastructure projects. At Icomera, we are committed to supporting agencies in building internal capabilities and making strategic, cost-effective decisions.

TM: You’ve mentioned some issues public operators face in dealing with the private sector. Are private investors such as Brightline also facing these problems?

GJL: Private investors like Brightline do encounter similar challenges. Brightline is an intriguing case because, while privately operated, it relies on public funding in the form of subsidies, including access to low or zero-interest bonds. This financial support has been crucial for their operations. It’s commendable that they’ve leveraged these opportunities.

Brightline demonstrates a more innovative approach to infrastructure development compared to traditional public sector methods. They have the flexibility to execute projects and pursue initiatives that are often constrained within the public sector.

One key aspect of Brightline’s strategy is their focus on land use. Unlike public agencies, Brightline can integrate real estate development around their stations, enhancing the overall value of their infrastructure investment. This approach mirrors successful transit models seen globally, including historical precedents in the United States.

If we’re to make substantial investments in public transit that maximize societal benefits, we must prioritize thoughtful land use planning around transit hubs. This approach not only enhances transportation infrastructure but also revitalizes surrounding communities.

TM: Taking all these factors into account, how do you see the industry moving forward in the short term?

GJL: Looking ahead, the United States is experiencing a critical influx of capital into public transit—a much-needed boost after years of underinvestment. The industry is now racing to catch up, as illustrated by the challenges faced by Metra and other agencies in rapidly scaling infrastructure to meet demand. However, this urgency has also led to inefficiencies and waste in the procurement of rolling stock and infrastructure development.

Moving forward, I believe there’s an opportunity for a more innovative approach to project execution across the board. Brightline, as an example in intercity transit, demonstrates how effective collaboration and strategic use of resources can transform transportation infrastructure. I envision similar partnerships and strategies on a municipal level, where public transit projects can be delivered more efficiently while maximizing community benefits and leveraging strategic land use.

In the next instalment of our interview with Icomera, we explore how the industry can leverage its investments to enhance the passenger experience, retain ridership, and ensure sustainable growth for the future.